Updated Fiat Grande Punto will show in Frankfurt

The world premiere of the updated version of hatchback Fiat Grande Punto will take place in September within the limits of the international motor show in Frankfurt. The official information on a novelty while is not present, however magazine Autocar has managed to receive some particulars about this car.

Alfa Romeo has presented special version Brera Italia Independent

In Italian small town Porto Cervo to Sardinia the presentation of the new special version supercar Alfa Romeo Brera under name Italia Independent has taken place.

Labels:

Alfa Romeo,

Brera,

hatchback,

Independent,

Italia,

presentation,

release,

special

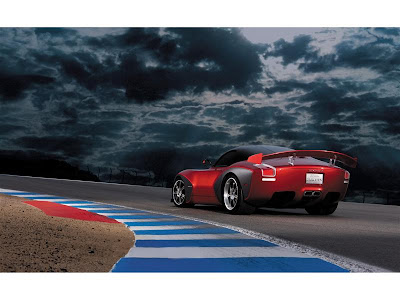

Luxury Small Car with sports look

We are sure you have seen many small car but this new small car is really special and you will come to know about this when you will give a look to photos of this car. Simply awesome design in black or red colour with broad tyre and attractive look.

If you will drive this new small car than you will put yourself in different league and you will be point of attraction as well.

If you will drive this new small car than you will put yourself in different league and you will be point of attraction as well.

Stocks falter as profit-selling sets in

The share market on Tuesday again turned lower as follow-up support turned shy under the mounting weight of profit-selling, but instances of buying were not wanting at the dips.

The KSE 100-share index early rose by 65 points at 8,352.91, but failed to sustain it on late-selling and ended the session with a fall of 40.28 points at 8,246.72. Its junior partner the KSE 30-share index managed to maintain most of the previous gains and was off only 2.13 points at 8,816.02.

The early run-up was caused by the improvement in Pakistan sovereign credit rating by the Standard and Poor’s (S&P) and its future positive impact on its credit worthiness in the international aiding agencies, said analyst Hasnain Asghar Ali.

Analyst Ahsan Mehanti attributed the correction to some technical factors and profit-taking in an overbought market.

“No one could disagree with the fact that the market is still ruling well below its potential of average trading volume of 400m shares daily,” he said, but some of the irritants following in quick succession scare away foreign investors even in perfect trading conditions.

The current positive comments on the performance of the bourse signal a major shift in the perceptions of foreign in vestors and there could be some pleasant surprises for the local investors in the coming weeks, he predicted.

A 20 per cent final cash dividend by the Nishat Mills was well received by the investors as its share value was quoted higher by Rs1.43 at 46.13 on 14m shares.

But it was essentially, the weak ness of the oil sector, which has neg ative impact on the market trend, despite the fact that Pakistan Petroleum maintained its upward drive on the strength of higher cash dividend plus bonus shares.

Prominent gainers were led by Siemens Pakistan and Sanofi Aventis which rose by Rs49.90 and Rs7.08. They were followed by Adamjee Insurance, Pakistan Tobacco, Indus Dyeing, National Refinery, Pakistan Petroleum, AlGhazi Tractors, Exide Pakistan and Grays of Cambridge, which posted gains ranging from Rs3.59 to Rs5.87.

Losers were led by Unilever Foods, Unilever Pakistan and Nestle Pakistan, off by Rs55, Rs95 and Rs55. Other notable losers included Wyeth Pakistan, EFU General, Millat Tractors, Pak–Suzuki Motors, Colgate Pakistan, Ferozsons, Shezan International and Treet Corporation, off by Rs4.46 to Rs43.14.

Trading volume rose further to 187.685m shares from the previous 146m shares as losers held comfortable lead over the gainers at 185 to 166, with 17 shares hold ing onto the last levels.

PTCL again led the list of actives, up Rs1.01 at Rs21.98 on 20m shares followed by D.G. Khan Cement, up Rs1.50 at Rs35.64 on 18m shares, Azgard Nine, firm by 69 paisa at Rs27.04 on 12m shares, OGDC, off Rs2.09 on 11m shares, Pak PTA, steady by eight paisa at Rs3.48 on 10m shares and JS & Co, up 43 paisa at Rs24.65 also on 10m shares.

Pakistan Petroleum followed them, higher by Rs4.33 at Rs205.36 on 9m shares, Bank Alfalah, unchanged at Rs11.73 on 8m shares and Arif Habib Securities, lower 44 paisa at Rs1.87 on 7m shares.

FORWARD COUNTER: Nishat Power led the list of actives on this counter, steady by 18 paisa at Rs16.19 on 0.798m shares, followed by D.G. Khan Cement (August delivery), up Rs1.45 at Rs35.71 on 0.382m shares, OGDC, off Rs2.16 at Rs96.74 on 0.196m shares and Pakistan Petroleum, higher by Rs6.66 at Rs205.58 on 0.170m shares.

DEFAULTER COMPANIES: Mixed trend was again seen on this counter but price changes were mostly fractional barring Al-Azhar Textiles and Syed Match, which rose and fell by Re1 each at Rs2.90 and Rs17.

Get Informer means To Get Informed on All Information Here. Fun, Songs, Videos, Latest Pictures, Google Adsense, Urdu SMS, Poetry, Cricket and More. Just Keep Visitin For more Updates

The KSE 100-share index early rose by 65 points at 8,352.91, but failed to sustain it on late-selling and ended the session with a fall of 40.28 points at 8,246.72. Its junior partner the KSE 30-share index managed to maintain most of the previous gains and was off only 2.13 points at 8,816.02.

The early run-up was caused by the improvement in Pakistan sovereign credit rating by the Standard and Poor’s (S&P) and its future positive impact on its credit worthiness in the international aiding agencies, said analyst Hasnain Asghar Ali.

Analyst Ahsan Mehanti attributed the correction to some technical factors and profit-taking in an overbought market.

“No one could disagree with the fact that the market is still ruling well below its potential of average trading volume of 400m shares daily,” he said, but some of the irritants following in quick succession scare away foreign investors even in perfect trading conditions.

The current positive comments on the performance of the bourse signal a major shift in the perceptions of foreign in vestors and there could be some pleasant surprises for the local investors in the coming weeks, he predicted.

A 20 per cent final cash dividend by the Nishat Mills was well received by the investors as its share value was quoted higher by Rs1.43 at 46.13 on 14m shares.

But it was essentially, the weak ness of the oil sector, which has neg ative impact on the market trend, despite the fact that Pakistan Petroleum maintained its upward drive on the strength of higher cash dividend plus bonus shares.

Prominent gainers were led by Siemens Pakistan and Sanofi Aventis which rose by Rs49.90 and Rs7.08. They were followed by Adamjee Insurance, Pakistan Tobacco, Indus Dyeing, National Refinery, Pakistan Petroleum, AlGhazi Tractors, Exide Pakistan and Grays of Cambridge, which posted gains ranging from Rs3.59 to Rs5.87.

Losers were led by Unilever Foods, Unilever Pakistan and Nestle Pakistan, off by Rs55, Rs95 and Rs55. Other notable losers included Wyeth Pakistan, EFU General, Millat Tractors, Pak–Suzuki Motors, Colgate Pakistan, Ferozsons, Shezan International and Treet Corporation, off by Rs4.46 to Rs43.14.

Trading volume rose further to 187.685m shares from the previous 146m shares as losers held comfortable lead over the gainers at 185 to 166, with 17 shares hold ing onto the last levels.

PTCL again led the list of actives, up Rs1.01 at Rs21.98 on 20m shares followed by D.G. Khan Cement, up Rs1.50 at Rs35.64 on 18m shares, Azgard Nine, firm by 69 paisa at Rs27.04 on 12m shares, OGDC, off Rs2.09 on 11m shares, Pak PTA, steady by eight paisa at Rs3.48 on 10m shares and JS & Co, up 43 paisa at Rs24.65 also on 10m shares.

Pakistan Petroleum followed them, higher by Rs4.33 at Rs205.36 on 9m shares, Bank Alfalah, unchanged at Rs11.73 on 8m shares and Arif Habib Securities, lower 44 paisa at Rs1.87 on 7m shares.

FORWARD COUNTER: Nishat Power led the list of actives on this counter, steady by 18 paisa at Rs16.19 on 0.798m shares, followed by D.G. Khan Cement (August delivery), up Rs1.45 at Rs35.71 on 0.382m shares, OGDC, off Rs2.16 at Rs96.74 on 0.196m shares and Pakistan Petroleum, higher by Rs6.66 at Rs205.58 on 0.170m shares.

DEFAULTER COMPANIES: Mixed trend was again seen on this counter but price changes were mostly fractional barring Al-Azhar Textiles and Syed Match, which rose and fell by Re1 each at Rs2.90 and Rs17.

Get Informer means To Get Informed on All Information Here. Fun, Songs, Videos, Latest Pictures, Google Adsense, Urdu SMS, Poetry, Cricket and More. Just Keep Visitin For more Updates

New software to bring internet to low-cost mobile phones

SAN FRANCISCO, Aug 25: Microsoft on Monday unveiled software that lets Twitter, Facebook and other hot Internet services be delivered to low-cost mobile “feature phones” common in developing countries.

The US technology giant will debut OneApp in South Africa and hopes to swiftly roll it out in India, China and other countries where millions of people use feature phones instead of powerful smart phones.

“We designed OneApp from the ground up on feature phones with very limited memory and processing capabilities,” said Amit Mital, corporate vice president of the Unlimited Potential Group and Startup Business Accelerator at Microsoft.

“OneApp will be able to help people do things they couldn’t do before with their feature phone — anything from paying their bills to help ing diagnose their health issues or just staying connected with friends and family.” Feature phones typically combine calling capabilities with one or two other functions such as playing music or games.

Such devices rely on General Packet Radio Service (GPRS) networks with users unable to browse the Internet and typically paying as they go to download data. In contrast, smart phones are essentially pocketsized computers with wireless Internet connectivity.

“With a GPRS-enabled cell phone, consumers can now be part of the app experience, which is taking the world by storm,” said Mark Levy, joint chief executive of Blue Label Telecoms.

Microsoft teamed with Blue Label Telecoms to make OneApp part of a new “mibli” mobile service to be offered free in South Africa, according to Mital.

“We’re particularly excited by the technology’s capacity to transform nearly any cell phone into a highly sophisticated, cost-effective and userfriendly transactional device,” Levy said.

Feature phones are far more common than smart phones in emerging markets, according to Microsoft.

“Right now you have smart phones that are really expensive and feature phones that are free or near-free, and there is a grey area in the middle,” said analyst Rob Enderle of Enderle Group in Silicon Valley.

“This could close the gray area. It’s a win for folks who didn’t think feature phones were capable enough for them but didn’t want to spend the money on a smartphone.” The rate of mobile telephone adoption in places such as India and China is meteoric, with a clear hunger for access to popular Internet services such as social networks and microblogging, Mital said.

OneApp hosts software “in the cloud” — as a service on the Internet — so a feature phone’s scant power can be devoted temporarily to whichever applications people opt for, according to Microsoft.

“Think of it as a caching mechanism where the Internet is the place your data is stored and then, when needed, downloaded to the phone,” Mital said.

“It means resources are only being used for a single application at any moment, lowering data charges, which is especially important in markets where people don’t have all-you-can-eat data plans.” A standardised OneApp platform for applications should let developers take advantage of economies of scale, opening flood gates for new programmes for feature phones, according to Enderle.—AFP

Get Informer means To Get Informed on All Information Here. Fun, Songs, Videos, Latest Pictures, Google Adsense, Urdu SMS, Poetry, Cricket and More. Just Keep Visitin For more Updates

The US technology giant will debut OneApp in South Africa and hopes to swiftly roll it out in India, China and other countries where millions of people use feature phones instead of powerful smart phones.

“We designed OneApp from the ground up on feature phones with very limited memory and processing capabilities,” said Amit Mital, corporate vice president of the Unlimited Potential Group and Startup Business Accelerator at Microsoft.

“OneApp will be able to help people do things they couldn’t do before with their feature phone — anything from paying their bills to help ing diagnose their health issues or just staying connected with friends and family.” Feature phones typically combine calling capabilities with one or two other functions such as playing music or games.

Such devices rely on General Packet Radio Service (GPRS) networks with users unable to browse the Internet and typically paying as they go to download data. In contrast, smart phones are essentially pocketsized computers with wireless Internet connectivity.

“With a GPRS-enabled cell phone, consumers can now be part of the app experience, which is taking the world by storm,” said Mark Levy, joint chief executive of Blue Label Telecoms.

Microsoft teamed with Blue Label Telecoms to make OneApp part of a new “mibli” mobile service to be offered free in South Africa, according to Mital.

“We’re particularly excited by the technology’s capacity to transform nearly any cell phone into a highly sophisticated, cost-effective and userfriendly transactional device,” Levy said.

Feature phones are far more common than smart phones in emerging markets, according to Microsoft.

“Right now you have smart phones that are really expensive and feature phones that are free or near-free, and there is a grey area in the middle,” said analyst Rob Enderle of Enderle Group in Silicon Valley.

“This could close the gray area. It’s a win for folks who didn’t think feature phones were capable enough for them but didn’t want to spend the money on a smartphone.” The rate of mobile telephone adoption in places such as India and China is meteoric, with a clear hunger for access to popular Internet services such as social networks and microblogging, Mital said.

OneApp hosts software “in the cloud” — as a service on the Internet — so a feature phone’s scant power can be devoted temporarily to whichever applications people opt for, according to Microsoft.

“Think of it as a caching mechanism where the Internet is the place your data is stored and then, when needed, downloaded to the phone,” Mital said.

“It means resources are only being used for a single application at any moment, lowering data charges, which is especially important in markets where people don’t have all-you-can-eat data plans.” A standardised OneApp platform for applications should let developers take advantage of economies of scale, opening flood gates for new programmes for feature phones, according to Enderle.—AFP

Get Informer means To Get Informed on All Information Here. Fun, Songs, Videos, Latest Pictures, Google Adsense, Urdu SMS, Poetry, Cricket and More. Just Keep Visitin For more Updates

Modern Car from BMW called GINA

If you love concept cars or new cars than here is another master piece for you. We are sure that you will simply love the look of this car instantly and would love to have taste drive for this car.

The main attraction of this new car is their light which makes this car separate from other cars. Name of this car from BMW is GINA

The main attraction of this new car is their light which makes this car separate from other cars. Name of this car from BMW is GINA

What Is An Adverse Credit Remortgage?

It is often necessary to remortgage your home. The term of the original mortgage may have expired or you just may want to take advantage of a lower interest rate with a new lender. But this can be difficult to do if you have adverse credit. What is adverse credit? It is just another way of saying bad or poor credit. Adverse credit can be a negative influence on all sorts of purchases or loans. If you have adverse credit and you need to refinance your home, this is where adverse credit remortgage comes in.

What is adverse credit remortgage? It is for people with bad credit who can’t get financing through normal procedures. Also known as adverse credit loans, these refinancing mortgages are for anyone who has defaults, court injunctions, bankruptcy, or late and missed payments on their credit history. Normally, people with bad or adverse credit cannot get a loan from other lenders. So an adverse credit remortgage basically pays off the old mortgage with a new one. But how does it work? If you have adverse credit and need to refinance your home, you may find the following information helpful.

Get Informer means To Get Informed on All Information Here. Fun, Songs, Videos, Latest Pictures, Google Adsense, Urdu SMS, Poetry, Cricket and More. Just Keep Visitin For more Updates

Why Would You Remortgage With Adverse Credit

The main reason to apply for a remortgage on your home is to save money. If the national interest rate has dropped since you home was originally mortgaged, then you are spending more money over the long run on interest. Often, lenders offer a two year fixed rate but after the two years is up, the interest rate may change. The interest may actually increase if you have adverse credit. If that happens, you need to find a new lender.

Another reason for an adverse credit remortgage is that the payments for the original mortgage may be too high. If a person is having problems making their monthly payments, either the payment was too high to begin with or your financial situation changes, then you need to find a way to reduce your payments. If the original lender is unwilling to work with you to lower the payments, then you should seek out a lender that offers adverse credit remortgages.

Many times people with adverse credit have unexpected bills that need to be paid. Perhaps that is the reason for their bad credit in the first place. If so, that person could use some extra spending money for bills. A good way to get this is to remortgage your home at a higher amount to get some extra cash.

Get Informer means To Get Informed on All Information Here. Fun, Songs, Videos, Latest Pictures, Google Adsense, Urdu SMS, Poetry, Cricket and More. Just Keep Visitin For more Updates

How Do You Remortgage With An Adverse Credit History

What makes adverse credit remortgage loans work is that the financial firm has your home as collateral. So if you should default on the loan, the firm has something tangible that they can collect on. It makes it easier to get a loan based on collateral value as opposed to just a good credit score.

Adverse credit remortgages are easy to apply for and you can even do it online. There are a several online remortgage websites that specialize in adverse credit loans and refinancing for people with bad credit. These sites are full of helpful information so you can see if a remortgage finance is right for you. Each remortgage finance firm’s site has a link to an application form. Just click on it and it takes you straight to the form along with instructions on how to fill it out. The application form for adverse credit remortgages will need such personal information as your credit score, employment and work history, annual income, personal ID such as social security numbers, and details about your home.

Adverse credit remortgages are easy to apply for and you can even do it online. There are a several online remortgage websites that specialize in adverse credit loans and refinancing for people with bad credit. These sites are full of helpful information so you can see if a remortgage finance is right for you. Each remortgage finance firm’s site has a link to an application form. Just click on it and it takes you straight to the form along with instructions on how to fill it out. The application form for adverse credit remortgages will need such personal information as your credit score, employment and work history, annual income, personal ID such as social security numbers, and details about your home.

If you don’t want to do it online, you can also check with your local financial institutes to se if any of them deal in adverse credit remortgages. Chances are a normal lender will not but even if they don’t, they might be able to offer advice or have some contact information for an institute that does handle these types of mortgages.

You should be sure to do plenty of research before you sign a remortgage deal. After all, you want to be sure to get the best deal possible so you want to comparison shop. I have said this many times before. Never go with the first offer. Chances are there will be a better offer somewhere else. The thing to keep in mind about signing an adverse credit remortgage deal is that the payments that you get may not be the best that someone with superior credit might get. Adverse credit remortgages are designed to improve your credit rating by giving you a much lower interest rate that will save you money and make it easier to pay off your loan. But remember that you are putting your home at risk. If you have bad credit because you have a history of not paying your bills, there is a chance you could lose your home. So think carefully before deciding on an adverse credit remortgage deal.

Get Informer means To Get Informed on All Information Here. Fun, Songs, Videos, Latest Pictures, Google Adsense, Urdu SMS, Poetry, Cricket and More. Just Keep Visitin For more Updates

Subscribe to:

Comments (Atom)